Are you ready to take the next step towards ensuring your health and well-being? Look no further! In this informative article, we will provide you with a simple and easy-to-follow guide on how to sign up for Medicare. Whether you’re turning 65 or have a qualifying disability, we’ve got you covered. So grab a cup of tea, sit back, and let’s navigate the Medicare enrollment process together.

A Step-by-Step Guide to Signing Up for Medicare

Are you nearing the age of 65 or dealing with a disability or end-stage renal disease? If so, it’s time to start thinking about signing up for Medicare. With its various parts and coverage options, Medicare can seem overwhelming, but don’t worry! This friendly guide will walk you through the process step-by-step, ensuring you understand your eligibility, the different parts of Medicare, how and when to enroll, and how to apply. So let’s get started!

1. Determine your eligibility

Age requirement

The first thing to consider when signing up for Medicare is your age. Typically, you become eligible for Medicare when you turn 65. However, if you’re under 65 and have a disability or have been diagnosed with end-stage renal disease, you may also qualify. Knowing your eligibility status is essential before proceeding with the enrollment process.

Disability requirement

If you have been receiving Social Security disability benefits for at least 24 months, you automatically become eligible for Medicare. This helps ensure that individuals with disabilities have access to necessary medical coverage. Keep in mind that you will still need to enroll in Medicare during the appropriate enrollment periods.

End-stage renal disease requirement

Individuals with end-stage renal disease (ESRD), also known as kidney failure, are eligible for Medicare regardless of their age. Whether you need dialysis or a kidney transplant, Medicare provides the necessary coverage. It’s important to understand the specific requirements and options available to you if you qualify under this category.

2. Understand the different parts of Medicare

To make informed decisions about Medicare, it’s crucial to understand its different parts. Medicare is divided into four primary parts: Part A, Part B, Part C, and Part D. Additionally, there is Medigap, which serves as supplemental insurance to cover expenses not covered by Original Medicare.

Part A: Hospital insurance

Medicare Part A, also known as hospital insurance, covers inpatient hospital stays, skilled nursing facility care, hospice care, and limited home healthcare services. Most people do not have to pay a premium for Part A, but there may be deductibles and coinsurance costs.

Part B: Medical insurance

Medicare Part B covers medical services and supplies needed to diagnose or treat medical conditions. This includes doctor visits, preventive services, outpatient care, and durable medical equipment. Part B requires a monthly premium, and there may be deductibles and coinsurance costs.

Part C: Medicare Advantage

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare. It combines Part A and Part B coverage and is offered by private insurance companies approved by Medicare. Medicare Advantage plans often include additional benefits like prescription drug coverage and may have different costs and restrictions compared to Original Medicare.

Part D: Prescription drug coverage

Medicare Part D provides coverage for prescription drugs. It is available to anyone with Medicare and can be added either through a standalone Part D plan or as part of a Medicare Advantage plan. Part D plans have monthly premiums, deductibles, and copayments, and the specific drugs covered vary by plan.

Medigap: Supplemental insurance

Medigap, also known as Medicare Supplement Insurance, is additional insurance that helps cover the “gaps” in Original Medicare. These gaps can include deductibles, coinsurance, and certain healthcare expenses incurred while traveling outside of the United States. Medigap plans are sold by private insurance companies and can provide financial peace of mind.

3. Gather necessary information

Before applying for Medicare, it’s important to gather certain information that will be required during the enrollment process. Having this information readily available will make the process smoother and more efficient.

Social Security number

Your Social Security number is a crucial piece of information that will be required when applying for Medicare. Make sure you have your Social Security card or the number itself accessible when you begin the enrollment process.

Proof of citizenship or legal residency

To be eligible for Medicare, you need to provide proof of your citizenship or legal residency in the United States. This can be done by submitting a copy of your birth certificate, passport, or other approved documentation. It’s essential to have this information ready when applying to avoid any delays or complications.

Employment history and employer details

When enrolling in Medicare, you will need to provide information about your employment history and current employer. This includes dates of employment, job titles, and employer addresses. Having this information prepared beforehand will ensure accuracy and streamline the application process.

Health insurance information

If you currently have health insurance coverage, particularly through your employer, gather the necessary details about your coverage. This can include insurance policy numbers, group numbers, and any applicable documentation. Understanding your existing coverage will help you make informed decisions about your Medicare options.

4. Decide when to enroll

Once you’ve determined your eligibility, it’s crucial to understand the different enrollment periods for Medicare. The timing of your enrollment can impact your coverage start date and may affect your ability to make certain coverage choices.

Initial enrollment period

The initial enrollment period for Medicare begins three months before your 65th birthday and lasts for seven months. This is the best time to enroll in Medicare to ensure you have coverage starting when you turn 65. Missing this period may result in delayed coverage or penalties in certain cases.

Special enrollment period

In some situations, you may qualify for a special enrollment period outside of the initial enrollment period. This can occur if you are covered by group health insurance through your or your spouse’s employer. Understanding the specific circumstances that can trigger a special enrollment period is important to ensure you don’t miss out on critical coverage.

General enrollment period

If you miss your initial enrollment period and do not qualify for a special enrollment period, you can still enroll in Medicare during the general enrollment period. This period runs from January 1st to March 31st each year, with coverage starting on July 1st. It’s important to note that late enrollment may result in higher premiums, so it’s best to enroll as soon as you become eligible.

5. Choose your Medicare coverage options

With a solid understanding of the different parts of Medicare, it’s time to choose your coverage options. Medicare offers two primary choices: Original Medicare and Medicare Advantage. Additionally, you can add Part D for prescription drug coverage.

Original Medicare

Original Medicare consists of Part A (hospital insurance) and Part B (medical insurance). Together, these parts provide a baseline of coverage for medical services and hospital stays. Original Medicare allows you to choose any doctor or hospital that accepts Medicare.

Medicare Advantage

Medicare Advantage, also known as Part C, combines the benefits of Part A and Part B into a single plan. Medicare Advantage is offered by private insurance companies and often includes additional benefits like dental, vision, or prescription drug coverage. Medicare Advantage plans may require you to use a network of providers.

Prescription drug coverage

Medicare Part D provides coverage for prescription drugs. If you opt for Original Medicare, you may want to consider adding a standalone Part D plan to ensure access to affordable medications. If you choose Medicare Advantage, prescription drug coverage may already be included in your plan.

6. Apply for Medicare online

Applying for Medicare online is a convenient and straightforward option. Follow these steps to complete the process online:

Create a My Social Security account

Before applying online, create a My Social Security account on the Social Security Administration (SSA) website. This account will give you secure access to your personal information and allow you to apply for Medicare.

Complete the online application

Once you have your My Social Security account, log in and navigate to the Medicare application. Fill out the required fields and provide the requested information, such as your Social Security number and proof of citizenship or legal residency.

Verify your information

Review all the information you entered to ensure accuracy and completeness. Check for any errors or missing details. It’s crucial to provide correct information to avoid any complications or delays in the enrollment process.

Submit the application

Once you have verified all your information, submit the online application. You will receive confirmation of your application submission, and your Medicare card will be mailed to you. It’s a good practice to keep a record of the confirmation for your reference.

7. Apply for Medicare by phone

If you prefer a more personal approach, you can apply for Medicare by phone. Follow these steps to complete the application over the phone:

Call the Social Security Administration

Contact the Social Security Administration at their toll-free number to initiate the Medicare application process. The representative will guide you through the application and address any questions or concerns you may have.

Provide necessary information

During the phone call, be prepared to provide your Social Security number, proof of citizenship or legal residency, as well as any other required information. Having these documents readily available will expedite the process and ensure accuracy.

Complete the application over the phone

Answer all the questions posed by the representative accurately and honestly. It’s essential to provide complete and correct information to avoid any issues with your Medicare enrollment. Once all the necessary information is gathered, the representative will process your application.

8. Apply for Medicare in person

If you prefer face-to-face interaction, you can apply for Medicare by visiting a local Social Security office. Follow these steps to complete the application in person:

Visit a local Social Security office

Locate the nearest Social Security office in your area and plan a visit. Ensure you have enough time set aside for the appointment, as wait times may vary.

Schedule an appointment

To streamline your application process, consider scheduling an appointment with the Social Security office beforehand. This will help reduce potential wait times and ensure you have the staff’s undivided attention when completing your application.

Bring necessary documents

Before going to the Social Security office, gather all the required documents, including your Social Security number, proof of citizenship or legal residency, employment history, employer details, and any other relevant information. Having these documents in hand will prevent any delays or complications.

Complete the application in person

Once at the Social Security office, a staff member will guide you through the Medicare application. Provide accurate and complete information, answering all questions to the best of your ability. The staff will process your application and provide you with a confirmation.

9. Review your Medicare coverage

After successfully enrolling in Medicare, it’s crucial to review your coverage to ensure you fully understand it and make any necessary adjustments. Here are some important steps to follow:

Understand your benefits

Take the time to familiarize yourself with the benefits and coverage provided by your chosen Medicare plan. This includes understanding the services covered, any deductibles or copayments required, and any limitations or restrictions on coverage.

Review your plan’s costs

Ensure you understand the costs associated with your Medicare coverage. This includes premiums, deductibles, copayments, and coinsurance. Pay close attention to any out-of-pocket maximums that may exist, as well as any additional costs for services not covered by your plan.

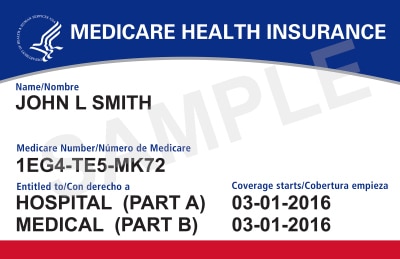

Check for any enrollment errors

While Medicare enrollment is generally smooth, errors can occur. Review your Medicare card, summary of benefits, and any other enrollment documents for accuracy. If you notice any discrepancies, contact Medicare or the Social Security Administration to rectify the situation promptly.

10. Understand the Medicare waiting period

When signing up for Medicare, it’s important to be aware of the waiting period for coverage. Here’s what you need to know:

Learn about the waiting period for coverage

In most cases, there is a waiting period before Medicare coverage begins. For example, if you enrolled during your initial enrollment period, coverage typically starts on the first day of your birth month. Understanding this waiting period allows you to plan and ensure you have the appropriate coverage in the interim.

Know when your coverage begins

Be aware of the specific date when your Medicare coverage begins. This will help you plan any necessary medical appointments or procedures, ensuring you have coverage in place when you need it.

Consider additional health insurance if needed

If you have a gap in coverage between your current health insurance and the start of your Medicare coverage, consider exploring options for temporary or additional coverage. This can provide you with peace of mind and help bridge any potential gaps in healthcare coverage.

By following this step-by-step guide, you can navigate the process of signing up for Medicare with confidence and ease. Remember to determine your eligibility, understand the different parts of Medicare, gather necessary information, decide when to enroll, choose your coverage options, apply through your preferred method, review your coverage, and be aware of the waiting period. With Medicare’s comprehensive coverage, you can ensure your healthcare needs are met as you enter this new chapter of your life.