So, you’re at that stage in life where enrolling in Medicare is on the horizon, and you’re wondering how to get started. Well, fret not, because in this article, we’ve got you covered! We’ll walk you through all the essential information you need to know about enrolling in Medicare. From eligibility criteria to enrollment deadlines, we’ll break it down in a friendly and easy-to-understand way. So, let’s dive right in and demystify the process of signing up for Medicare, ensuring you make the most informed decisions for your healthcare needs.

Eligibility for Medicare

Age requirements

To be eligible for Medicare, you must be a U.S. citizen or a permanent legal resident who has lived in the country for at least five years. The main requirement for Medicare eligibility is age. Most individuals become eligible for Medicare when they turn 65 years old. This is based on the assumption that you or your spouse have worked and paid Medicare taxes for at least 10 years.

Disability requirements

In addition to age, certain individuals under the age of 65 may be eligible for Medicare based on disability. If you have been receiving Social Security disability benefits for at least 24 months, or if you have been diagnosed with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS), you may qualify for Medicare before the age of 65.

Eligibility for Social Security

Social Security eligibility is closely linked to Medicare eligibility. Most individuals become eligible for Social Security benefits at age 62, but full retirement age is typically between 66 and 67 years old, depending on the year you were born. If you are eligible for Social Security benefits, you will also become eligible for Medicare when you reach the age requirement.

Eligibility for Railroad Retirement Benefits

Railroad workers and their spouses may be eligible for Medicare based on their railroad retirement benefits. The eligibility criteria for railroad retirement benefits mirror those of Social Security. If you qualify for railroad retirement benefits, you will also be eligible for Medicare when you meet the age requirements.

Different Parts of Medicare

Medicare Part A

Medicare Part A, also known as hospital insurance, covers inpatient care in hospitals, skilled nursing facilities, hospice care, and some home health care services. Most people do not have to pay a premium for Medicare Part A as long as they or their spouse have paid Medicare taxes while working.

Medicare Part B

Medicare Part B, or medical insurance, covers outpatient services, including doctor visits, preventive care, and medically necessary supplies. Unlike Part A, Part B requires a monthly premium. The premium is set based on your income and can be deducted from your Social Security benefits.

Medicare Part C

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B). Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans provide Part A and Part B coverage, and often include additional benefits such as prescription drug coverage, dental care, and vision services.

Medicare Part D

Medicare Part D is a prescription drug coverage program. It helps pay for the cost of prescription medications and is available to anyone eligible for Medicare. Part D plans are offered by private insurance companies and can vary in cost and coverage. It is important to select a plan that covers your specific medications at an affordable price.

When to Enroll

Initial Enrollment Period

Your Initial Enrollment Period (IEP) is the first opportunity you have to sign up for Medicare. It begins three months before your 65th birthday and ends three months after your birthday month. If you become eligible for Medicare due to a disability, your IEP is based on the 25th month of receiving disability benefits.

Special Enrollment Periods

Outside of the Initial Enrollment Period, there are certain circumstances that may qualify you for a Special Enrollment Period (SEP). For example, if you or your spouse have group health coverage through an employer or union, you may be able to delay enrolling in Medicare Part B without a late enrollment penalty.

General Enrollment Period

If you missed your Initial Enrollment Period and do not qualify for a Special Enrollment Period, you have the option to enroll during the General Enrollment Period (GEP). The GEP runs from January 1st to March 31st each year. However, it’s important to note that if you enroll during the GEP, your coverage will not start until July 1st, and you may be subject to a late enrollment penalty.

Enrolling in Medicare Part A

Automatic enrollment

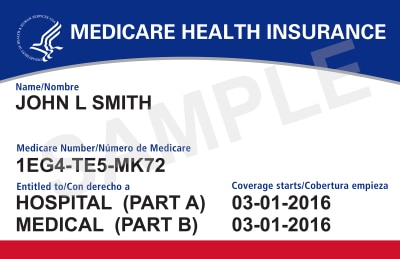

If you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Part A when you become eligible. You will receive your Medicare card and other important information about your coverage in the mail.

Enrollment with Social Security

If you are not yet receiving Social Security benefits, you will need to proactively enroll in Medicare Part A. You can do this by visiting your local Social Security office or by applying online through the Social Security Administration’s website.

Enrollment outside of Initial Enrollment Period

If you missed your Initial Enrollment Period, you can still enroll in Medicare Part A during the General Enrollment Period mentioned earlier. However, keep in mind that you may have to pay a higher premium for late enrollment.

Enrolling in Medicare Part B

Automatic enrollment

Similar to Part A, if you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Part B when you become eligible. If you do not want Medicare Part B coverage, you will need to follow the instructions provided in the enrollment materials or contact Social Security to opt-out.

Enrollment through Social Security

If you are not receiving Social Security benefits, you will need to enroll in Medicare Part B by contacting the Social Security Administration. You can do this by visiting your local Social Security office, calling their toll-free number, or applying online through their website.

Enrollment outside of Initial Enrollment Period

If you missed your Initial Enrollment Period for Medicare Part B, you can still enroll during the General Enrollment Period. However, similar to Part A, you may be subject to a late enrollment penalty, and your coverage will not start until July 1st.

Enrolling in Medicare Part C

Types of Medicare Advantage Plans

Medicare Part C, or Medicare Advantage, offers a range of different plan options to choose from. These plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service (PFFS) plans, and Special Needs Plans (SNPs). Each plan has its own network of doctors and hospitals, and they may offer different coverage options and costs.

Enrollment through private insurance companies

To enroll in a Medicare Advantage plan, you will need to contact a private insurance company that offers these plans in your area. The insurance company will provide you with information about their specific plans, costs, and enrollment process. It’s important to compare different plans before making a decision.

Enrollment periods

There are specific enrollment periods for Medicare Advantage plans. The Initial Enrollment Period for Part C aligns with your Initial Enrollment Period for Medicare Parts A and B. Additionally, there is an Annual Enrollment Period that occurs each year from October 15th to December 7th, during which you can change or enroll in Medicare Advantage plans.

Enrolling in Medicare Part D

Prescription drug coverage and enrollment

Medicare Part D is the program that provides coverage for prescription medications. To enroll in a Part D plan, you must be eligible for Medicare and actively enrolled in either Medicare Part A or Part B. It’s important to note that Part D plans are not automatically included in Original Medicare or Medicare Advantage plans, so you need to enroll separately.

Enrollment through private insurance companies

Similar to Medicare Advantage plans, Part D plans are offered by private insurance companies. You can enroll in a Part D plan by contacting the insurance company directly or by using the Medicare Plan Finder tool on the official Medicare website. The tool allows you to compare different plans based on your location and medication needs.

Medicare’s Extra Help Program

Medicare’s Extra Help program provides financial assistance to individuals with limited income and resources to help cover the costs of prescription drugs. If you qualify for the program, you may be eligible for reduced premiums, deductibles, and copayments. To apply for Extra Help, you can contact the Social Security Administration or visit their website.

Costs and Coverage

Premiums and deductibles

Medicare Part A is generally premium-free for most individuals who have paid Medicare taxes while working. However, there may be a deductible and coinsurance costs associated with hospital stays and other inpatient services. Medicare Part B requires a monthly premium, and the amount can vary based on your income. Both Part A and Part B have annual deductibles that you must meet before Medicare starts paying its share.

Out-of-pocket costs

Original Medicare (Parts A and B) also includes out-of-pocket costs such as coinsurance and copayments. These costs can add up, especially if you require frequent medical services or hospital stays. To help manage these expenses, many individuals choose to supplement their Medicare coverage with a Medigap (Medicare Supplement) plan or enroll in a Medicare Advantage plan, which often includes out-of-pocket cost limits.

Coverage limitations and exclusions

While Medicare provides comprehensive coverage for a wide range of medical services, there are some limitations and exclusions. For example, Medicare typically does not cover routine dental care, vision care, or hearing aids. It’s important to review the specific coverage details of your Medicare plan to understand what is included and what may require additional coverage or alternative payment options.

Choosing between Medicare and Employer Coverage

Understanding employer coverage options

If you are still actively working and have employer-sponsored health insurance, you may need to decide whether to enroll in Medicare or keep your employer coverage. It is important to understand the rules and coordination of benefits between Medicare and your employer coverage. You should consider factors such as costs, coverage benefits, provider networks, and the potential impact on any retirement benefits.

Deciding to keep or cancel employer coverage

In some cases, it may be advantageous to keep both Medicare and employer coverage. This can provide you with additional healthcare options and potentially lower out-of-pocket costs. However, there are instances where it may be more beneficial to cancel your employer coverage and rely solely on Medicare. It is crucial to carefully evaluate your individual circumstances and consult with a benefits advisor or Human Resources representative before making a decision.

Additional Resources and Support

Medicare.gov website

The official Medicare website, Medicare.gov, is a valuable resource for information about Medicare enrollment, coverage options, costs, and available plans. The website offers a variety of tools and resources to help you navigate the complex world of Medicare and make informed decisions about your healthcare coverage.

State Health Insurance Assistance Programs

State Health Insurance Assistance Programs (SHIPs) are state-funded programs that provide free, unbiased assistance and counseling to Medicare beneficiaries and their families. SHIPs can help answer questions, provide personalized guidance, and help you understand your Medicare rights and options. Each state has its own SHIP, and their contact information can be found on the Medicare.gov website.

Medicare beneficiaries helpline

Medicare beneficiaries can call a toll-free helpline to receive assistance and get answers to their Medicare-related questions. Representatives are available to provide information about eligibility, enrollment, coverage options, and more. The helpline is a valuable resource for those who need additional support or clarification regarding their Medicare benefits.

In conclusion, enrolling in Medicare is a critical step in securing your healthcare coverage as you age or face certain disabilities. Understanding the eligibility requirements, different parts of Medicare, enrollment periods, and coverage options is essential to ensure you choose the right plan for your needs. It is important to evaluate your specific circumstances, review the available resources, and consult with experts to make informed decisions about your Medicare enrollment. Remember, Medicare is a helpful program designed to provide you with the essential healthcare coverage you need, and with the right knowledge and support, you can navigate the process with ease.