Are you wondering how to sign up for Social Security? Look no further, because we have got you covered! In this article, we will guide you through the simple and straightforward process of signing up for Social Security. Whether you are approaching retirement or have a disability, we will provide you with all the information you need to navigate the applications and ensure a smooth sign-up experience. So, let’s get started on securing your future with Social Security!

How to Sign Up for Social Security

Social Security is a vital program that provides financial support to individuals and families during retirement, in the event of disability, or after the loss of a loved one. If you’re wondering how to sign up for Social Security, this comprehensive guide will walk you through the process step by step.

Eligibility Requirements

Before signing up for Social Security benefits, it’s important to understand the eligibility requirements. There are three key factors to consider:

Age Requirement

To qualify for retirement benefits, you must be at least 62 years old. However, the age at which you choose to start receiving benefits can have a significant impact on the amount you receive. It’s essential to carefully consider the financial implications of early or delayed retirement.

Citizenship or Residency Status

To be eligible for Social Security benefits, you must be either a U.S. citizen or a legal resident with a valid Social Security number. If you’re a non-citizen, you need to meet specific residency requirements to qualify.

Work Credits

In addition to meeting the age and citizenship requirements, you must have earned enough work credits to be eligible for Social Security benefits. Work credits are earned through paid employment and determine whether you’re considered “fully insured” for benefits.

Choosing an Appropriate Time to Sign Up

Once you meet the eligibility requirements, it’s crucial to consider the timing of your Social Security enrollment. There are three primary options to choose from:

Full Retirement Age

Your full retirement age is the age at which you’re entitled to receive your full Social Security benefits based on your birth year. This age varies between 66 and 67 for those born between 1943 and 1960. Waiting until your full retirement age ensures that you receive your maximum benefit amount.

Early Retirement

You have the option to start receiving Social Security benefits as early as age 62. However, keep in mind that your monthly benefit amount will be permanently reduced if you choose early retirement. This reduction can be as much as 30% if your full retirement age is 67.

Delayed Retirement

If you decide to delay your retirement beyond your full retirement age, you can increase your Social Security benefit amount. For each year you delay, your benefit will increase by a certain percentage, up until age 70. This increase is known as delayed retirement credits and can significantly boost your monthly benefit amount.

Understanding Social Security Benefits

Before signing up, familiarize yourself with the various types of Social Security benefits available:

Retirement Benefits

Retirement benefits are the most common type of Social Security benefit and provide a monthly income to eligible individuals who have reached the minimum age requirement. The amount you receive is based on your earnings history and the age at which you start taking benefits.

Spousal Benefits

If you’re married or have been divorced but were married for at least ten years, you may be eligible for spousal benefits. Spousal benefits allow you to receive a portion of your spouse’s or ex-spouse’s Social Security benefits, even if you never worked or had lower earnings.

Survivor Benefits

If your spouse or parent has passed away, you may be eligible for survivor benefits. These benefits can provide financial support to widows, widowers, and dependent children. The amount you receive depends on the deceased individual’s earning history and your relationship to them.

Disability Benefits

If you become disabled and are no longer able to work, you may be eligible for Social Security disability benefits. These benefits provide financial support to individuals with a qualifying disability that prevents them from engaging in substantial gainful activity. It’s important to note that there are specific criteria and a waiting period to qualify for disability benefits.

Gathering Necessary Documentation

Before signing up for Social Security, gather the required documentation to support your application:

Proof of Age

To verify your age, you’ll need to provide an original or certified copy of your birth certificate or passport. If you don’t have either of these documents, other acceptable forms of proof include hospital records, religious records, or naturalization papers.

Proof of Citizenship or Residency

To establish your citizenship or residency status, you’ll need to provide documents like a U.S. passport, Certificate of Naturalization, Certificate of Citizenship, or permanent resident card (green card).

Proof of Income

If you’re applying for retirement, spousal, or survivor benefits, you’ll also need to provide proof of your income. This includes documentation such as W-2 forms, self-employment tax returns, or pay stubs.

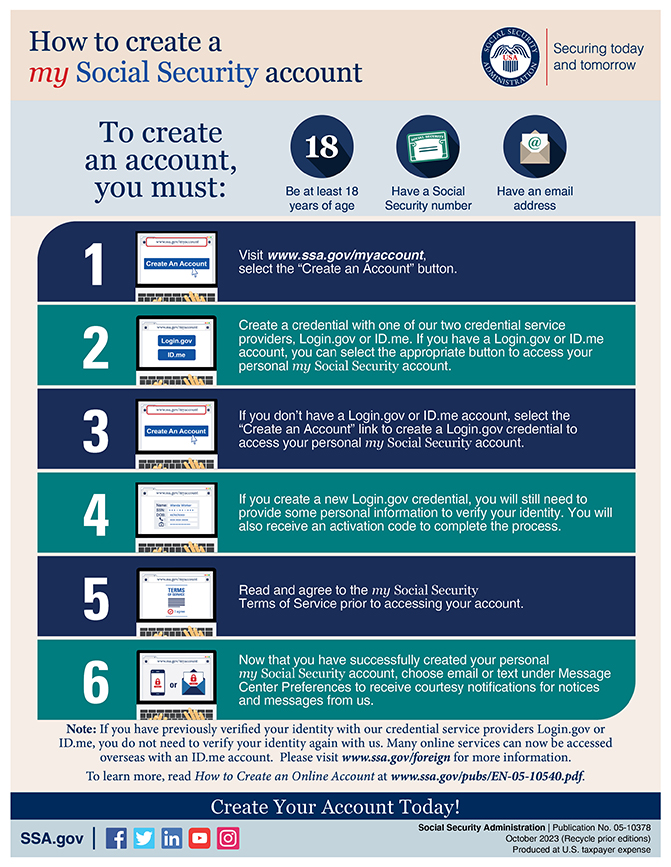

Creating a my Social Security Account

To sign up for Social Security benefits online, follow these steps:

- Visit the official Social Security website at www.ssa.gov.

- Click on the “Create an Account” option located on the homepage.

- Follow the prompts to verify your identity. You’ll need to provide personal information, such as your Social Security number, name, date of birth, and address.

- Once your identity is verified, you can set up a username and password for your my Social Security account.

Alternatives to Online Registration

If you prefer not to sign up online, there are alternative methods available:

Phone Registration

You can sign up for Social Security benefits by calling the Social Security Administration’s toll-free number at 1-800-772-1213. A representative will guide you through the application process over the phone.

In-Person Registration

Another option is to visit your local Social Security office in person. Schedule an appointment and bring all the necessary documentation with you. A representative will assist you in completing the application.

Completing the Application Form

Once you’ve chosen the method of registration, you’ll need to complete the Social Security application form. Here’s what you’ll need to provide:

Personal Information

This includes your name, Social Security number, date of birth, contact information, and marital status.

Employment History

You’ll need to provide details about your work history, including your employers’ names, dates of employment, and income earned.

Benefit Start Date

Specify when you want your Social Security benefits to start. The options include the month you reach full retirement age, or you can choose a later or earlier start date.

Spousal Information (if applicable)

If you’re claiming spousal benefits, provide your spouse’s name, date of birth, and Social Security number.

Direct Deposit Details

You’ll need to provide your bank account information for direct deposit of your Social Security benefits. This ensures a convenient and secure way to receive your payments.

Submitting the Application

After completing the application form, you’ll need to submit it to the Social Security Administration. Here are your options:

Online Submission

If you signed up online, you can submit your application electronically through your my Social Security account.

Mailing the Application

If you completed a paper application, you can mail it to your local Social Security office using the address provided on their website. Be sure to include all required documentation and send it using certified mail for tracking purposes.

Checking the Application Status

Once you’ve submitted your application, it’s natural to want to know its status. Here’s how you can check:

Using the Online my Social Security Account

Log in to your my Social Security account to check the status of your application. You’ll be able to see if it’s under review, approved, or if any additional information or documentation is needed.

Contacting the Social Security Administration

If you prefer to speak with a representative directly, you can contact the Social Security Administration’s toll-free number at 1-800-772-1213. Provide your application details, and they will assist you in obtaining the status.

Receiving the Social Security Card

After your application is approved, you’ll receive your Social Security card. Here’s what you can expect:

Timing of Card Delivery

Typically, you receive your Social Security card within ten business days after your application is processed. However, delivery times may vary, so it’s best to be patient.

Verifying the Accuracy of the Information

Upon receiving your Social Security card, carefully review the information on it. Check that your name, Social Security number, and other details are accurate. Contact the Social Security Administration immediately if you notice any mistakes.

Signing up for Social Security is an essential step in securing your financial future and accessing the benefits you’ve earned. By following this comprehensive guide, you can navigate the process with confidence and ensure a smooth enrollment experience. Remember to gather all necessary documentation, choose the right time to sign up, and explore the various types of benefits available to you. With careful preparation and understanding, you’ll be well on your way to enjoying the security and peace of mind that Social Security provides.