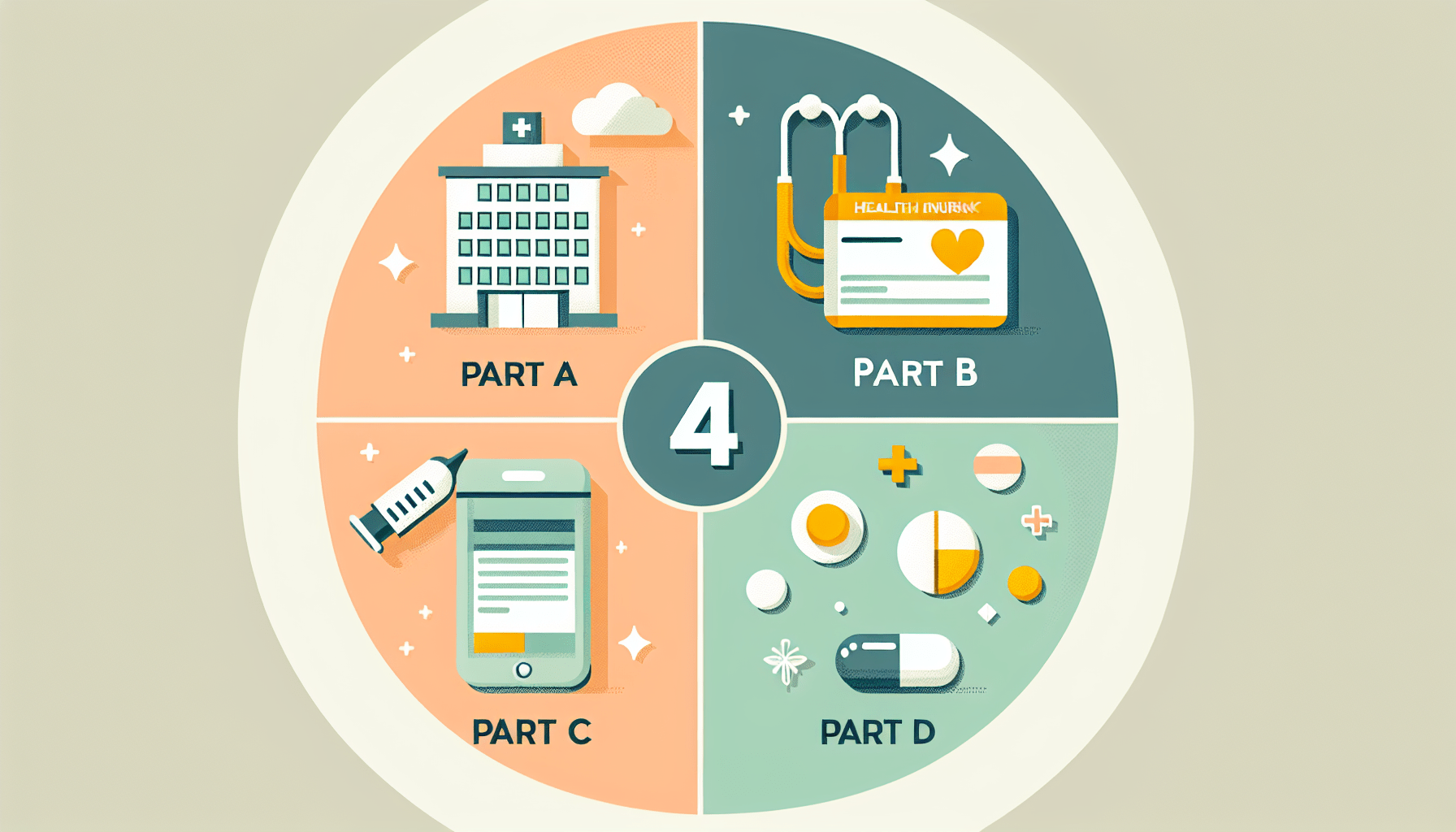

Curious about Medicare and what it covers? Look no further! This article will give you a comprehensive rundown of the different parts of Medicare – Part A, Part B, Part C, and Part D – and what each part offers in terms of coverage. Whether you’re approaching or have already reached the age of 65, or if you’re someone with specific medical conditions or disabilities, understanding the ins and outs of Medicare is essential. From eligibility and enrollment to costs and upcoming changes, we’ve got you covered with all the information you need to navigate the complex world of Medicare. So, let’s dive in and discover the benefits each part offers!

Part A: Hospital Insurance

Part A of Medicare, also known as Hospital Insurance, provides coverage for inpatient hospital care, skilled nursing facility care, hospice care, and some types of home health care. This coverage is designed to ensure that you have access to necessary medical services when you need them most.

Inpatient Hospital Care

Part A covers inpatient hospital care, which includes services such as a semi-private room, meals, general nursing care, drugs administered as part of your inpatient treatment, and other hospital services and supplies. This coverage is essential for those who require a hospital stay due to illness or injury.

Skilled Nursing Facility Care

If you require skilled nursing or rehabilitation services after a hospital stay, Part A covers care in a skilled nursing facility. This type of care can include services like physical therapy, occupational therapy, speech-language pathology services, and more. It’s important to note that Part A coverage for skilled nursing facility care is only available for a limited period and under specific conditions.

Hospice Care

Medicare Part A also provides coverage for hospice care for terminally ill individuals who have a life expectancy of six months or less. Hospice care focuses on providing comfort and support to individuals and their families during this challenging time. Part A covers services such as pain relief medications, medical equipment, and emotional support.

Home Health Care

Part A covers certain types of home health care services when you meet specific criteria. Home health care services can include skilled nursing care, physical therapy, occupational therapy, speech-language pathology services, and more. This coverage is beneficial for individuals who require medical care or assistance but prefer to receive it in the comfort of their own homes.

Part A is an integral part of Medicare, providing coverage for hospital and post-hospital care services. Understanding the details of this coverage can help you make informed decisions about your healthcare needs.

Part B: Medical Insurance

Part B of Medicare, known as Medical Insurance, covers a wide range of services aimed at preventing, diagnosing, and treating medical conditions. This coverage is essential for ensuring that you have access to necessary medical care outside of a hospital setting.

Doctor Services

Part B covers services provided by doctors and other healthcare professionals, such as physician office visits, specialist visits, and certain preventive services. These services are crucial for maintaining good health, managing chronic conditions, and addressing new health concerns that may arise.

Outpatient Care

Outpatient care, which includes services like ambulance transportation, mental health care, and certain surgeries or procedures performed in a non-hospital setting, is also covered by Part B. This coverage ensures that you have access to necessary medical care without having to be admitted to a hospital.

Preventive Services

Preventive services are a vital component of Part B coverage. Medicare covers a range of preventive services, such as screenings for various conditions, vaccines, and counseling services aimed at preventing illness or detecting potential health issues at an early stage. Taking advantage of these services can help you maintain your well-being and catch any potential problems before they become more serious.

Durable Medical Equipment

Part B also covers durable medical equipment (DME) that is medically necessary, such as wheelchairs, walkers, oxygen equipment, and certain prosthetic devices. This coverage ensures that individuals who require these essential items can access them without facing significant financial burdens.

Part B provides comprehensive coverage for medical services outside of a hospital setting. It is important to understand the scope of this coverage and utilize it effectively to meet your healthcare needs.

Part C: Medicare Advantage Plans

Medicare Advantage plans, also known as Part C, are offered by private insurance companies approved by Medicare. These plans provide an alternative way to receive your Medicare benefits, combining the coverage of Part A and Part B, along with additional benefits that may not be covered by Original Medicare.

Additional Coverage Options

Part C plans often provide additional coverage options, such as vision, dental, and prescription drug coverage, which are not included in Original Medicare. These extra benefits can help you manage your overall healthcare costs and improve your overall well-being.

Combine Part A, Part B, and usually Part D

Medicare Advantage plans combine the coverage of Part A, Part B, and, in most cases, Part D (prescription drug coverage). This consolidation simplifies your coverage by bundling all your Medicare benefits into one plan, typically with a single insurance company as your point of contact.

Part C plans are designed to offer more comprehensive coverage and a wider range of benefits compared to Original Medicare. It’s essential to carefully review the details of different Medicare Advantage plans to select the one that best meets your unique healthcare needs.

Part D: Prescription Drug Coverage

Part D of Medicare provides prescription drug coverage. This coverage is designed to help you manage the cost of prescription medications, ensuring that you can access the necessary drugs to maintain your health and well-being.

Retail Prescription Drugs

Part D covers retail prescription drugs, including those prescribed by your doctor or purchased over the counter at a pharmacy. This coverage includes a wide range of medications, from common maintenance drugs to specialized medications for chronic or acute conditions.

Mail-Order Prescription Drugs

In addition to retail coverage, Part D often includes mail-order prescription drug benefits. This service allows you to order a supply of medications and have them delivered to your home. Mail-order services can be especially convenient for individuals who require long-term medication regimens.

Preventive Drugs

Part D also covers certain preventive drugs, which can help you manage chronic conditions, prevent worsening health conditions, and improve overall health outcomes. Examples of preventive drugs that may be covered include vaccines, medications to prevent certain chronic diseases, and drugs to manage cardiovascular health.

Brand-Name and Generic Drugs

Part D coverage includes both brand-name and generic drugs. Generic drugs are often more affordable and provide the same therapeutic benefits as their brand-name counterparts. However, if your doctor determines that a brand-name medication is medically necessary, Part D coverage typically includes provisions for these higher-cost drugs.

Part D is a crucial component of Medicare, offering coverage for prescription medications that are essential for maintaining your health and managing chronic conditions. Understanding the details of this coverage can help you navigate the complex world of prescription drug expenses.

Medicare is a complex program with multiple parts that provide coverage for various healthcare services. Understanding the different parts and what they cover is essential for making informed decisions about your healthcare needs. Whether you need inpatient care, outpatient services, prescription drugs, or additional benefits, Medicare has options to ensure that you have access to the care you need. Take the time to explore your options and choose the Medicare coverage that best suits your unique healthcare needs.